Introduction

Many investors focus intensely on investment returns. They analyze market trends and seek high-growth assets. However, a crucial element often gets overlooked. This element significantly impacts your actual wealth. We are talking about the impact of taxes on your investments. Taxes can erode a substantial portion of your gains over time. Understanding tax-efficient investing strategies is vital. It helps to preserve and grow your capital. This guide introduces key concepts. It explores methods to minimize your tax burden. By doing so, you can maximize your long-term returns. This approach applies to various asset classes. It covers traditional investments and emerging digital assets. Prioritizing what you keep is as important as what you make. This perspective shifts your entire financial outlook. It empowers you to build lasting wealth more effectively. Learn how smart planning can make a difference.

Understanding the Tax Landscape for Investors

Navigating the investment world requires tax knowledge. Taxes can significantly reduce your net returns. Investors must understand different types of investment taxes. This knowledge is key to developing effective strategies. It helps in optimizing your financial outcomes.

Capital Gains Tax

Capital gains arise from selling an asset. This asset could be stocks, bonds, or real estate. The sale must be for more than its purchase price. There are two main types of capital gains. These depend on how long you held the asset.

- Short-Term Capital Gains: These apply to assets held for one year or less. They are taxed at your ordinary income tax rates. These rates can be quite high. For example, if you sell a stock quickly for a profit.

- Long-Term Capital Gains: These apply to assets held for more than one year. They typically receive preferential tax treatment. Their rates are often lower than ordinary income tax rates. This encourages longer-term investment.

Income Tax on Investments

Beyond capital gains, other investment income is taxable. Understanding these sources is crucial. It helps in planning your tax-efficient investing strategies.

- Dividends: These are payments from company profits to shareholders.

- Qualified Dividends: These are taxed at lower long-term capital gains rates. They must meet certain holding period requirements.

- Non-Qualified Dividends: These are taxed at your ordinary income tax rates.

- Interest Income: This comes from bonds, savings accounts, or CDs. It is generally taxed at ordinary income tax rates. There are exceptions, like municipal bonds.

- Rental Income: Profits from real estate rentals are also taxable income. Deductions are available for expenses.

Estate Tax Considerations

Estate tax applies to the transfer of wealth. It is levied upon a person’s death. This tax affects very large estates. Most investors will not encounter federal estate tax. However, some states have their own estate or inheritance taxes. Planning can help reduce this impact. It ensures more wealth passes to heirs.

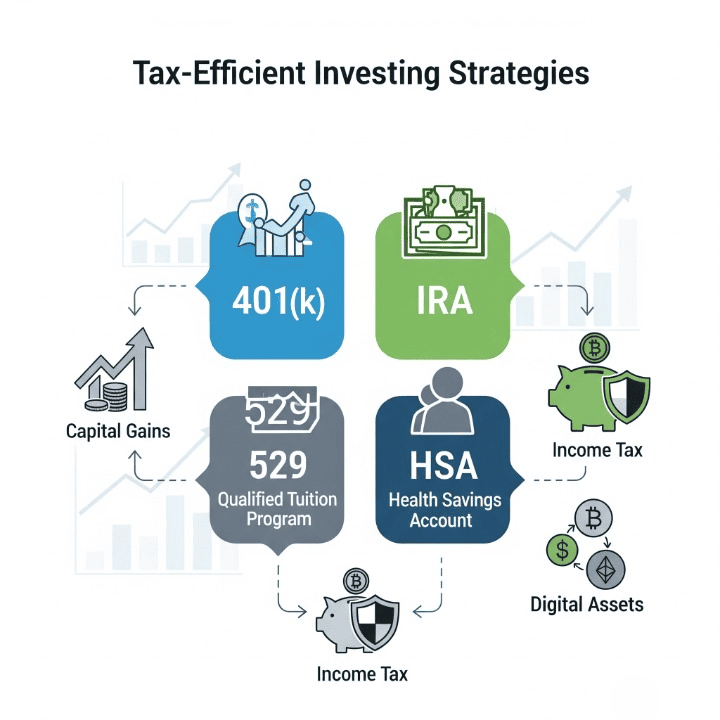

Tax-Advantaged Investment Accounts

Leveraging specific investment accounts is a cornerstone. It is a critical part of tax-efficient investing strategies. These accounts offer significant tax benefits. They can defer or even eliminate taxes. This applies to growth and withdrawals.

Retirement Accounts

These accounts are designed for long-term savings. They provide powerful tax incentives. Maximizing contributions is a smart move.

- 401(k) Plans: Offered by employers, these allow pre-tax contributions. Your money grows tax-deferred. You only pay taxes upon withdrawal in retirement. Many employers offer matching contributions. This is essentially free money for your future.

- Individual Retirement Arrangements (IRAs):

- Traditional IRA: Contributions might be tax-deductible. Growth is tax-deferred. Withdrawals in retirement are taxed as ordinary income.

- Roth IRA: Contributions are made with after-tax dollars. Your investments grow tax-free. Qualified withdrawals in retirement are also tax-free. This offers immense benefits for future tax planning.

- Self-Directed IRA: This allows for a broader range of investments. It can include real estate or even cryptocurrencies. Always understand the rules.

Education Accounts

Saving for education can also be tax-efficient. These accounts help families save. They minimize the tax burden on college savings.

- 529 Plans: These plans offer tax-free growth. Withdrawals are also tax-free if used for qualified education expenses. Many states offer state income tax deductions. This applies to contributions.

- Coverdell Education Savings Accounts (ESAs): These also offer tax-free growth. Withdrawals for qualified education expenses are tax-free. They have income limitations and lower contribution limits.

Health Savings Accounts (HSAs)

HSAs are often called “triple tax-advantaged.” They are a powerful tool for health and retirement. You must have a high-deductible health plan (HDHP) to qualify.

- Contributions are tax-deductible: These reduce your taxable income.

- Growth is tax-free: Your investments grow without yearly tax drag.

- Qualified withdrawals are tax-free: Funds used for eligible medical expenses are tax-free.

- After age 65, funds can be withdrawn for any purpose. They are taxed as ordinary income, like a traditional IRA. This makes them an excellent retirement savings vehicle.

Strategies for Tax-Efficient Portfolio Management

Beyond account types, specific strategies enhance tax efficiency. These approaches are crucial. They help manage your investment portfolio effectively. They aim to reduce your annual tax bill.

Asset Location

Asset location is a key tax-efficient investing strategy. It involves placing different asset types in specific accounts. This minimizes tax drag.

- Taxable Accounts: Best for assets with lower tax consequences. These include qualified dividends and municipal bonds.

- Tax-Deferred Accounts (e.g., Traditional IRA/401(k)): Ideal for highly taxed assets. These include actively managed funds or bonds generating taxable interest. Growth is deferred until retirement.

- Tax-Free Accounts (e.g., Roth IRA/HSA): Perfect for assets with high growth potential. These include growth stocks or real estate. Future withdrawals are tax-free.

Tax-Loss Harvesting

This strategy involves selling investments at a loss. These losses can then offset capital gains. They can also offset a limited amount of ordinary income.

- Offsetting Gains: Capital losses first offset capital gains.

- Offsetting Income: Up to $3,000 of remaining losses can offset ordinary income each year.

- Carrying Forward Losses: Any unused losses can be carried forward indefinitely. This reduces future tax liabilities.

- Wash-Sale Rule: Be aware of the wash-sale rule. You cannot buy a substantially identical security. This applies within 30 days before or after the sale.

Index Funds and Exchange-Traded Funds (ETFs)

These investment vehicles generally offer tax advantages. They are often more tax-efficient than actively managed mutual funds.

- Lower Turnover: Index funds and ETFs track an index. They trade less frequently. This generates fewer capital gains distributions.

- In-Kind Redemptions: ETFs can use a mechanism called “in-kind redemptions.” This allows them to manage capital gains. They can remove low-cost-basis shares without triggering a taxable event.

Qualified Dividends

As mentioned earlier, qualified dividends are taxed favorably. Focus on investments that generate these. This helps reduce your overall tax burden. Ensure your holding periods meet the requirements.

Municipal Bonds

These are debt securities issued by state and local governments. Their interest income is generally exempt from federal taxes. It may also be exempt from state and local taxes. This applies if you live in the issuing state. They are particularly attractive for high-income earners.

The Role of Crypto in a Tax-Efficient Portfolio

Cryptocurrencies present unique considerations. Their tax treatment is still evolving. However, basic principles of tax-efficient investing strategies apply. Understanding these rules is crucial. It helps navigate this dynamic asset class.

Taxation of Crypto Assets

The IRS generally treats cryptocurrencies as property. This impacts how they are taxed.

- Capital Gains: When you sell crypto for a profit, it’s a capital gain. This includes selling for fiat currency or exchanging for other crypto. Short-term and long-term rules apply, just like with stocks.

- Income Tax: Earning crypto through mining, staking, or airdrops is taxable income. This income is valued at its fair market value. It is valued on the day you receive it.

- Gifting and Donations: Gifting crypto is usually not a taxable event for the giver. Donating crypto to a qualified charity is tax-deductible. It avoids capital gains tax on appreciation.

Record-Keeping Importance

Accurate record-keeping is paramount for crypto investors. The volatile nature of crypto makes this even more critical. Keep track of all transactions.

- Purchase Date and Price: Essential for determining holding periods. This affects short-term vs. long-term gains.

- Sale Date and Price: Needed to calculate gains or losses.

- Transaction Fees: These can often be added to your cost basis. They reduce your taxable gain.

- Wallet Addresses: Document all transfers between wallets.

- Software and Services: Utilize crypto tax software. These tools automate tracking and reporting.

Future Regulations and Planning

The regulatory landscape for crypto is still developing. Stay informed about changes. This includes potential new tax laws. Future regulations could impact existing tax-efficient investing strategies.

- Staking and DeFi: Rules around staking rewards and DeFi activities are complex. They may vary by jurisdiction.

- NFTs: Non-fungible tokens are typically treated like other property. Their sale generates capital gains.

- Professional Advice: Consider consulting a tax professional. One specializing in digital assets is recommended. They can provide tailored guidance.

Integrating Tax Efficiency into Retirement Planning

Retirement planning heavily relies on tax-efficient investing strategies. Your choices now impact your future income. They also affect your tax liability in retirement. Strategic decisions can significantly boost your nest egg.

Withdrawal Strategies

How you withdraw money from various accounts matters. This impacts your tax bill in retirement. A common strategy is to “fill up the lower tax brackets.”

- Taxable Accounts First: Consider drawing from taxable accounts initially. This leaves tax-advantaged accounts to grow longer.

- Tax-Deferred Accounts (Traditional 401(k)/IRA): Withdraw enough to stay in lower tax brackets. These withdrawals are taxed as ordinary income.

- Tax-Free Accounts (Roth IRA/HSA): Save these for later. Use them to manage your taxable income. They are excellent for large, tax-free expenses.

Roth Conversions

A Roth conversion involves moving pre-tax money. This is typically from a Traditional IRA or 401(k). You move it into a Roth IRA. You pay income tax on the converted amount in the year of conversion.

- Benefits: Future growth and qualified withdrawals from the Roth are tax-free. This can be beneficial if you expect higher tax rates in retirement.

- Timing: Conversions are often done during lower-income years. Or during market downturns. This minimizes the tax hit.

- Pro-Rata Rule: Be aware of this rule. It applies if you have both deductible and non-deductible IRA contributions.

Required Minimum Distributions (RMDs)

RMDs are mandatory withdrawals. They apply to most tax-deferred retirement accounts. These begin at a certain age. The age is currently 73 (as of 2023).

- Purpose: The government wants to tax your deferred savings.

- Penalties: Failing to take RMDs can result in steep penalties.

- Planning for RMDs: Consider strategies to manage RMDs. Qualified Charitable Distributions (QCDs) can help. These involve direct transfers from an IRA to a charity. They can count towards your RMD. They are also excluded from your taxable income.

Insurance and Tax Benefits

Insurance products often serve more than just protection. Some can also play a role. They can enhance your tax-efficient investing strategies. They offer unique tax benefits for growth and wealth transfer.

Life Insurance

Certain types of life insurance combine protection with investment features.

- Cash Value Growth: Whole life and universal life policies build cash value. This cash value grows on a tax-deferred basis. It means you don’t pay taxes on the gains yearly.

- Tax-Free Withdrawals/Loans: You can access the cash value. This is done through policy loans or withdrawals. These are generally tax-free up to your basis. Loans need to be repaid. If not repaid, the death benefit is reduced. The loan may become taxable upon lapse or surrender.

- Tax-Free Death Benefit: The death benefit paid to beneficiaries is typically tax-free. This provides a valuable legacy for your loved ones. It avoids income and estate taxes for beneficiaries.

Annuities

Annuities are contracts with an insurance company. They provide a stream of income in retirement. They offer tax-deferred growth.

- Tax-Deferred Growth: Investments within an annuity grow tax-deferred. You only pay taxes when you take withdrawals. This allows for compounding without yearly tax drag.

- Types of Annuities:

- Fixed Annuities: Offer a guaranteed interest rate.

- Variable Annuities: Allow investment in sub-accounts. Their value fluctuates with market performance.

- Indexed Annuities: Link returns to a market index. They often include downside protection.

- Withdrawal Taxation: When you withdraw funds from an annuity, the earnings portion is taxed as ordinary income. The original principal (cost basis) is returned tax-free.

- Early Withdrawal Penalties: Withdrawals before age 59½ may incur a 10% IRS penalty. This is in addition to ordinary income taxes. Surrender charges from the insurance company also apply.

Conclusion

Mastering tax-efficient investing strategies is pivotal. It transforms your financial future. It’s not merely about maximizing returns. It is about maximizing what you actually keep. This guide introduced fundamental concepts. It covered capital gains, income taxes, and estate considerations. We explored powerful tax-advantaged accounts. These include 401(k)s, IRAs, 529 plans, and HSAs. Each offers unique benefits for savings goals. We also discussed advanced portfolio management techniques. Asset allocation, tax-loss harvesting, and strategic fund choices were highlighted. Even the evolving landscape of cryptocurrency taxation was addressed. Integrating these strategies into retirement planning is essential. It ensures your hard-earned money works harder for you. Remember, financial planning knowledge is your most valuable asset. Continuously educating yourself is key. Always consider consulting a qualified financial advisor. They can provide personalized guidance. They will help tailor these strategies to your unique situation. This ensures a robust and tax-optimized financial plan.