Introduction

Navigating the complex world of insurance often feels like a guessing game. Traditional models apply broad strokes, grouping diverse individuals into vast risk pools. This approach can leave many wondering about the fairness of their premiums. It especially impacts those who practice careful, low-risk behaviors. The desire for more equitable and personalized financial solutions is growing. This is where a revolutionary concept takes center stage. It is transforming how we think about risk and protection.

Usage-Based Insurance (UBI) represents a significant paradigm shift. It moves away from static demographic data. Instead, it embraces dynamic, real-time behavioral insights. This innovative approach allows insurance providers to tailor policies. Premiums reflect actual individual risk. This article will explore the rise of UBI. We will delve into its mechanics, benefits, and challenges. We will also examine its profound implications. This includes impacts on personal finance and broader market dynamics.

Understanding UBI is crucial for modern financial planning. It offers a path to more intelligent insurance choices. It can potentially unlock significant cost savings. Furthermore, it encourages safer personal habits. This creates a win-win scenario for policyholders and insurers alike. The shift towards behavior-driven policies is undeniable. It marks a new era in risk management. It also redefines the relationship between individuals and their financial protection.

Understanding Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) is an innovative insurance model. It determines premiums based on a policyholder’s actual behavior. Unlike traditional insurance, UBI does not rely solely on generalized statistics. Instead, it uses specific, measurable data. This data reflects how an individual drives or lives. It creates a highly personalized risk profile. This approach means your premium directly reflects your habits. It rewards safer behaviors with lower costs.

The core principle of UBI is simple yet powerful. It links what you pay to how you live. For auto insurance, this means monitoring driving patterns. It considers factors like mileage, speed, and braking habits. This direct correlation offers a fairer assessment of risk. It moves away from broad actuarial assumptions. UBI offers a dynamic pricing model. It constantly adapts to individual performance. This leads to more equitable insurance premiums for many.

UBI marks a significant evolution in the insurance industry. It shifts the focus from “who you are” to “how you act.” This model aligns better with modern demands. Consumers seek transparency and personalization. The rise of **telematics** technology makes UBI possible. It allows for the accurate collection and analysis of behavioral data. This technology is fundamental to behavior-driven policies. It provides the necessary insights. These insights help to precisely calculate risk.

How Telematics Works

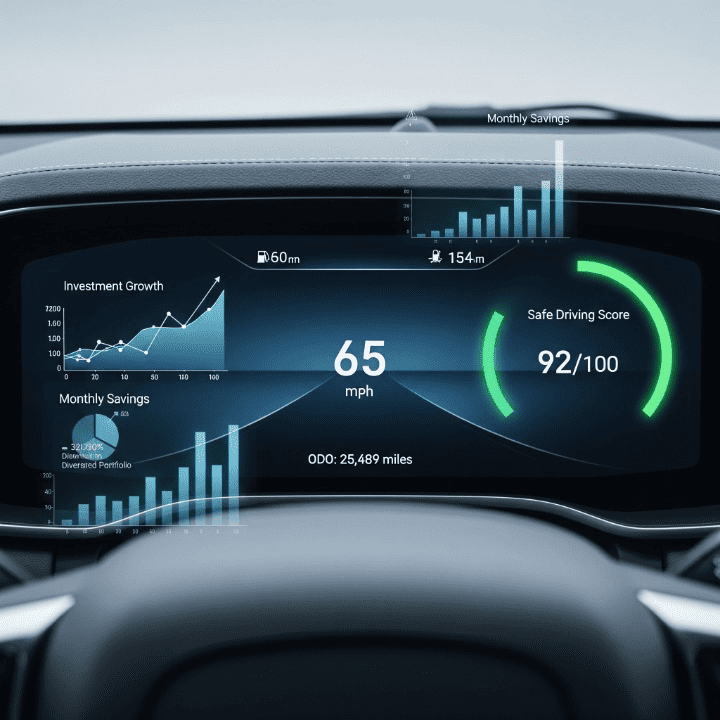

**Telematics** is the backbone of Usage-Based Insurance. It refers to a method of monitoring vehicles. It combines telecommunications and informatics. Telematics devices collect various data points. These devices can be physical dongles. They plug into a car’s onboard diagnostic (OBD-II) port. Alternatively, they can be smartphone applications. These apps use the phone’s built-in sensors. The data collected provides a comprehensive picture of driving habits.

Key data points typically include several important metrics. These often consist of total mileage driven. They also track the time of day driving occurs. Hard braking incidents are recorded. Rapid acceleration events are also noted. Driving speed relative to speed limits is monitored. Even the types of roads driven on may be considered. This granular data allows insurers to understand individual risk. It moves beyond just age or vehicle type. This sophisticated data collection enhances **risk assessment** capabilities.

Once collected, this data is securely transmitted. It goes to the insurance provider for analysis. Advanced algorithms then process this information. They assign a driving score or risk profile. This score directly influences the policyholder’s premium. Good driving behaviors are rewarded. This can lead to significant savings. Conversely, risky habits may result in higher costs. The transparency of this system can encourage safer driving. It provides tangible financial incentives. This feedback loop is a key feature of UBI programs.

The Benefits of Behavior-Driven Policies

Behavior-driven policies, especially UBI, offer numerous advantages. These benefits extend to both policyholders and insurers. One of the most compelling is **personalized premiums**. Traditional insurance often averages risk across large groups. UBI, however, tailors rates to an individual’s actual behavior. This means careful drivers are not subsidizing risky ones. They can instead enjoy significantly lower costs. This fairness is a major draw for many consumers.

Another substantial benefit is the potential for **cost savings**. Safe drivers can see their insurance premiums decrease. This happens as they demonstrate responsible behavior. For those with excellent driving records, UBI can be a game-changer. It unlocks discounts that were previously unavailable. These savings can then be allocated elsewhere. This includes investments or other financial goals. Such flexibility greatly aids in sound **financial planning**.

UBI also promotes **enhanced safety** on the roads. Knowing that driving habits are being monitored encourages better behavior. Drivers become more conscious of their speed. They pay attention to braking and acceleration. This leads to fewer accidents. It also creates a safer environment for everyone. The feedback provided by some UBI programs reinforces positive changes. This continuous learning contributes to overall risk reduction.

Furthermore, these policies can lead to a **reduced carbon footprint**. If drivers are incentivized to drive less, they might. This reduces fuel consumption and vehicle emissions. It aligns with growing environmental consciousness. It also adds a societal benefit to individual financial savings. The system fosters a more mindful approach to vehicle use. This benefits both personal finances and the planet.

Finally, UBI offers greater **transparency** in premium calculations. Policyholders can often access their driving data. They can understand how their actions affect their rates. This demystifies the insurance process. It builds trust between the insurer and the insured. This clear understanding empowers individuals. They can actively manage their insurance costs. This level of insight is rarely found in traditional policies.

Who Benefits Most from UBI?

While UBI offers broad appeal, certain groups benefit more significantly. **Low-mileage drivers** are prime candidates for savings. If you drive infrequently or for short distances, your risk exposure is lower. UBI accurately reflects this reduced risk. It results in lower premiums compared to flat-rate policies. This is particularly advantageous for urban dwellers or those who commute less.

**Safe, responsible drivers** also stand to gain considerably. Individuals with a clean driving record are often penalized by traditional models. These models may factor in general statistics. UBI directly rewards good habits. This includes smooth acceleration, gentle braking, and adherence to speed limits. Their cautious approach translates into tangible financial benefits. It makes insurance more equitable for them.

**Young drivers seeking lower rates** can find UBI very appealing. Historically, young drivers face very high premiums. This is due to their perceived higher risk. UBI provides an opportunity to prove their responsibility. By demonstrating safe driving, they can access better rates sooner. This empowers them to control their insurance costs. It helps them build a positive driving history from the start.

Individuals actively focused on **financial planning** also find UBI valuable. Lower insurance costs mean more disposable income. This income can be directed towards savings, investments, or debt reduction. UBI integrates seamlessly into a holistic financial strategy. It helps optimize household budgets. It allows for more efficient allocation of funds. This proactive management contributes to long-term financial health.

Ultimately, anyone willing to modify their behavior can benefit. UBI is an excellent tool for those who prefer control. It allows them to influence their expenses directly. This empowers consumers. It makes insurance a more active, rather than passive, financial component. It’s about taking charge of your financial future.

Challenges and Considerations of UBI

Despite its many advantages, Usage-Based Insurance presents unique challenges. **Privacy concerns** are at the forefront of these discussions. The constant collection of personal driving data raises questions. People worry about who has access to this information. They also worry about how it might be used. Ensuring robust data protection is paramount for widespread adoption. Customers need to trust the system.

**Data security** is another critical consideration. Insurers must implement stringent measures. These measures protect sensitive information from breaches. Unauthorized access to driving data could have serious implications. It could compromise personal safety and financial well-being. The integrity of the collected data is also vital. Any manipulation or error could lead to unfair premiums. This could erode consumer confidence significantly.

The **accuracy of data** and potential for misinterpretation also pose issues. For instance, a sudden brake might be due to an emergency. It is not necessarily reckless driving. The system needs to differentiate between these scenarios. It must avoid penalizing unavoidable, safe actions. Overly simplistic algorithms could lead to frustration. They might result in perceived unfairness. This could deter drivers from participating.

**Technological barriers** can also be a hurdle. Not all vehicles are compatible with plug-in devices. Some drivers may be uncomfortable with smartphone app usage. They might worry about battery drain or data consumption. The installation and maintenance of devices could deter some users. Ensuring ease of access and use is crucial for broader appeal. The technology must be user-friendly.

Finally, **fairness for all drivers** remains a complex topic. What about individuals living in congested areas? Their driving behavior might appear riskier due to traffic patterns. This could happen despite careful driving. Or those with long, unavoidable commutes. UBI models must account for these contextual factors. They must avoid unintentionally disadvantaging certain demographics. This requires sophisticated design and constant refinement.

Addressing Privacy and Data Concerns

Addressing privacy and data concerns is essential for UBI’s success. Insurers are implementing several strategies. One key approach is using **opt-in models**. This ensures drivers willingly consent to data collection. Transparency about data usage is also vital. Policies must clearly outline what data is collected. They must state how it will be used. They should also specify who can access it. This empowers consumers to make informed choices.

**Anonymization of data** is another critical safeguard. This process removes personally identifiable information. It allows insurers to analyze driving patterns in aggregate. This helps improve their models. It does so without compromising individual privacy. Data aggregation can reveal trends. These trends inform pricing strategies. But they do so without linking specifics to any single person. This is especially useful for actuarial science.

Implementing **clear data usage policies** is paramount. These policies should be easily accessible and understandable. They must detail data retention periods. They should also explain data sharing practices. Policyholders need assurances. Their data will not be sold to third parties. They must know it won’t be used for purposes outside the insurance agreement. Strong contractual agreements provide this protection.

**Regulatory oversight** also plays a crucial role. Governments and industry bodies are developing guidelines. These help govern how UBI data is collected and used. Such regulations ensure consumer protection. They standardize practices across the industry. This creates a level playing field. It also fosters trust in UBI programs. This is vital for long-term growth and acceptance. This framework supports responsible innovation.

UBI’s Impact on the Insurance and Financial Landscape

The advent of Usage-Based Insurance profoundly impacts the insurance sector. It represents a significant **disruption of traditional insurance models**. These older models rely heavily on historical data. They use broad demographic risk assessments. UBI introduces a dynamic, real-time approach. This forces established insurers to adapt. They must innovate to remain competitive. The industry is moving towards more personalized offerings.

This shift has led to **increased competition among insurers**. Companies are vying to offer the most attractive UBI programs. They are developing sophisticated telematics solutions. They also focus on transparent pricing structures. This competition ultimately benefits consumers. It drives innovation and potentially lowers costs. Insurers must differentiate themselves. They do this by offering superior technology and better customer experiences. This pushes the entire industry forward.

UBI also increasingly integrates with broader **financial planning** strategies. Lower insurance costs mean more disposable income. This capital can be redirected. It can go towards investments or savings goals. Financial advisors can leverage UBI insights. They can help clients optimize their budgets. This helps create more robust long-term financial plans. Insurance becomes an active tool for wealth building.

Looking ahead, **future trends** point to more granular data collection. This includes more sophisticated AI-driven insights. Machine learning algorithms can identify complex driving patterns. They can predict risk with greater accuracy. This will allow for even more precise policy customization. The focus is shifting towards proactive risk management. Insurers can offer tips to improve driving. This helps prevent claims before they happen. This is a significant evolution for the industry.

The financial landscape sees insurance as more than just protection. It becomes an interactive component. It actively influences an individual’s financial health. This evolving role underscores UBI’s transformative power. It reshapes how we view and manage financial risks. It connects behavior directly to financial outcomes. This new approach empowers consumers more than ever before.

UBI and Investment Decisions

The savings from Usage-Based Insurance can directly influence **investment decisions**. When insurance premiums are lower, more capital becomes available. This freed-up money is not tied to fixed expenses. It can instead be channeled into various investment vehicles. This could include stocks, bonds, or even cryptocurrencies. The ability to save on essential services creates financial flexibility. This is a critical component of smart investing.

Consider the cumulative effect of lower insurance costs over time. Even small monthly savings can add up significantly. These accumulated savings can then be invested. Compounding returns can amplify this effect. This provides a substantial boost to an individual’s **investment portfolio**. It’s a direct example of how everyday financial choices impact long-term wealth accumulation. Every dollar saved can be a dollar invested.

UBI encourages a more disciplined approach to personal finance. Drivers who actively manage their behavior to lower premiums often apply similar diligence. This can extend to their investment strategies. They may seek out efficient ways to grow their money. This connection between responsible behavior and financial gain is powerful. It reinforces positive habits across different financial domains. It helps foster a culture of mindful financial management.

Furthermore, the data transparency in UBI can inform financial decisions. Understanding risk is central to both insurance and investing. UBI helps individuals grasp their risk profile more concretely. This knowledge can then be applied to investment choices. It helps them make informed decisions about risk tolerance. This improves the overall management of their **investment portfolio**. It helps ensure alignment with personal financial goals. It’s about a holistic view of financial health.

The Future of Usage-Based Insurance

The trajectory of Usage-Based Insurance suggests significant expansion. Its applications will likely go beyond auto insurance. We can anticipate its spread into areas like home insurance. Smart home devices could monitor property risks. This might include water leaks or fire hazards. Health insurance could also integrate UBI principles. Wearable technology could track activity levels. This could incentivize healthy lifestyles. This broader adoption reshapes personal and commercial insurance.

Further **integration with smart home devices and wearables** is inevitable. Imagine your home insurance premium adjusting based on proactive maintenance. Or your health insurance offering discounts for hitting fitness goals. This interconnected ecosystem will provide a comprehensive risk picture. It will also offer continuous opportunities for cost reduction. This creates a truly dynamic and responsive insurance experience. The possibilities for personalization are vast.

**Predictive analytics** will become even more sophisticated. AI and machine learning will analyze vast datasets. They will identify nuanced patterns. They can forecast potential risks with remarkable accuracy. This will allow insurers to offer highly individualized advice. They can help prevent incidents before they occur. This proactive approach benefits everyone. It minimizes losses for insurers. It enhances safety and well-being for policyholders. This moves beyond simply reacting to claims.

The **evolution of regulatory frameworks** will also be crucial. As UBI expands, new legal and ethical considerations emerge. Regulators will need to balance innovation with consumer protection. They will address issues like data ownership and algorithmic bias. Clear guidelines will ensure fair practices. They will foster public trust. This robust framework is essential for sustainable growth. It supports a fair and equitable market.

Ultimately, UBI is poised to become a cornerstone of modern **risk management** and **financial planning**. It moves us towards a future where insurance is not a static expense. Instead, it is an active tool. It empowers individuals to manage their risks effectively. It rewards responsible behavior. This paradigm shift will redefine our relationship with financial protection. It will make it more personalized, transparent, and empowering. It’s an exciting time for the financial world.

Conclusion

The journey through Usage-Based Insurance (UBI) reveals a significant evolution. It shows a transformation in how risk is assessed and managed. No longer are individuals confined to broad, generalized insurance categories. Instead, UBI offers a dynamic and personalized approach. It directly links premiums to individual behavior. This paradigm shift empowers consumers. It rewards safe choices with tangible financial benefits. It truly embodies the concept of “pay how you live.”

We have explored the intricate workings of UBI. We delved into the power of **telematics** data collection. The myriad benefits, from **personalized premiums** to **cost savings**, are clear. UBI also promotes safer driving. It fosters a more responsible approach to personal risk. While challenges like **privacy concerns** and **data security** exist, robust solutions are continuously emerging. These aim to build trust and ensure fairness for all.

The impact of UBI extends far beyond mere insurance premiums. It influences broader **financial planning** and **investment decisions**. By freeing up capital, UBI allows for greater financial flexibility. It enables individuals to invest more strategically. It fosters a mindset of proactive financial management. This innovation is reshaping the entire financial services landscape. It pushes towards more responsive and consumer-centric models.

As we look to the future, UBI is poised for even greater integration. It will encompass various aspects of our lives. From smart homes to wearable tech, the potential is immense. It will enhance our ability to manage and mitigate risks. Understanding UBI is therefore not just about insurance. It is about embracing a future where personal responsibility directly translates into financial well-being. It is about making informed choices. These choices shape a more secure and prosperous financial future for everyone.