Financial Planning

Navigating the World of Identity Theft Insurance: A Guide to Protecting Your Digital Life

Introduction In today’s interconnected world, your digital identity is one of your most valuable assets. Your personal information—from your Social Security number to your bank account details—is a target for cybercriminals. Identity theft is no longer just a risk; it’s a common reality that can have a devastating impact on your life, leading to financial […]

Building a Strong Financial Foundation: A Guide to the Basics of Personal Finance

Introduction Many people feel that managing money is an impossible task. They think it’s something only a small group of experts truly understands. But the truth is, personal finance is not about complex algorithms or endless spreadsheets. It’s about a few simple, foundational habits that anyone can master. Building a strong financial foundation is the […]

How to Build an Investing Plan: A Strategic Guide to Achieving Your Financial Goals

Introduction The world of investing can seem daunting. With countless options, market fluctuations, and endless advice, it’s easy to feel overwhelmed and unsure of where to start. However, successful investing isn’t about luck or complex financial secrets. It’s about having a clear, well-thought-out plan and sticking to it. A solid investing plan serves as your […]

Navigating the World of Renters Insurance: A Comprehensive Guide to Protecting Your Belongings

Introduction Many people who rent an apartment or a home believe they don’t need insurance. They assume their landlord’s policy will cover them in the event of a fire, a break-in, or a natural disaster. Unfortunately, this is a common and costly misconception. A landlord’s insurance policy protects the building itself, but it does not […]

Understanding the Rule of 72: A Simple Tool for Your Investing Future

Introduction The world of investing often seems complicated. You hear about stock tickers, market cycles, and complex financial theories. However, a powerful and surprisingly simple tool exists to help you understand one of the most fundamental concepts of wealth creation: the power of compounding. That tool is the Rule of 72. It’s a quick and […]

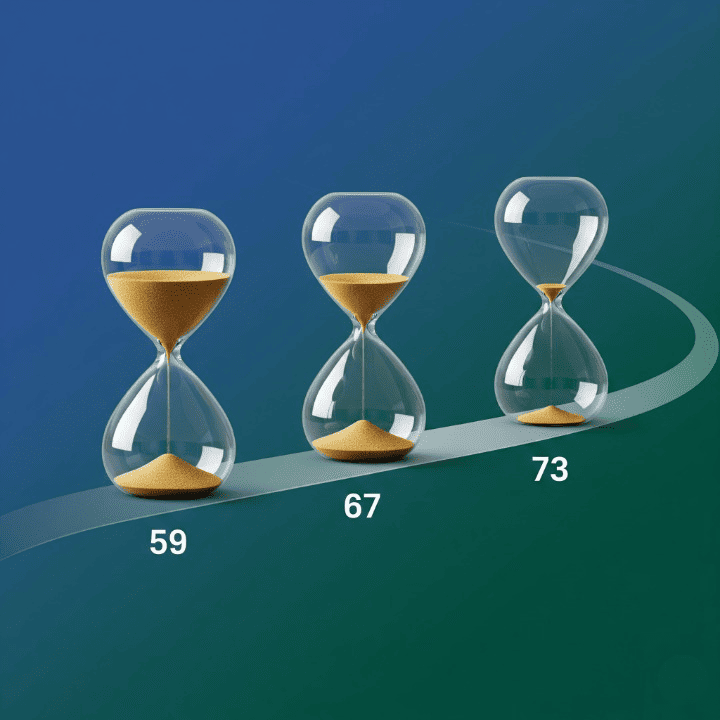

Understanding the Different Retirement Ages: A Guide to Financial Freedom

Introduction The term “retirement age” is a concept most people are familiar with. It often conjures a single number—like 65 or 67—that marks the end of our working lives. However, in reality, there’s no one-size-fits-all retirement age. Instead, there are several key ages that have a significant impact on your retirement planning and financial future. […]

Understanding Initial Coin Offerings (ICOs): A Guide for Investors

Introduction The world of cryptocurrency is full of innovative ways for projects to raise capital. While traditional startups go through rounds of venture capital funding, many crypto projects launch with an Initial Coin Offering (ICO). An ICO is a fundraising method where a new project sells its native cryptocurrency tokens to early investors. For a […]

The Power of Compounding: How to Make Your Money Work for You

Introduction When you start investing, you’ll often hear about the magic of compounding. While the term might sound complex, the concept is incredibly simple and is arguably the most powerful force for building wealth over time. In a nutshell, compounding is the process of earning returns on your initial investment and then earning returns on […]

Navigating the World of Auto Insurance: A Comprehensive Guide to Protecting Your Ride

Introduction A car is an essential part of daily life for most people. It gets us to work, helps us run errands, and provides the freedom to travel. With this freedom, however, comes significant risk. A single accident can result in thousands of dollars in damages, medical bills, and legal fees, creating a financial catastrophe […]

How to Build an Emergency Fund: Your Ultimate Guide to Financial Security

Introduction Life is full of unexpected twists and turns. A sudden job loss, an unexpected car repair, or a medical emergency can throw your financial planning off track in an instant. Without a safety net, these events can force you into high-interest debt, jeopardizing years of hard work. This is where an emergency fund comes […]