retirement savings

How to Calculate Financial Needs for a Secure Retirement

Introduction: The Urgency to Calculate Retirement Needs Calculate retirement needs to secure your future in today’s evolving landscape. As populations age and life expectancy rises, people face the challenge of making their assets last longer. Recent global trends indicate retirees regularly spend 20 to 30 years without employment income. Meanwhile, inflation continually reduces the purchasing […]

Retirement planning guide with key strategies and essential tools

Retirement planning guide with strategies, tools, tax insights, and investment tips for a safe future. Learn main steps for a secure retirement now.

Mastering Your Personal Finances: A Guide to Financial Freedom

Introduction Achieving financial freedom is a goal many aspire to. Yet, the path often seems complex and daunting. Navigating budgets, investments, and future planning can feel overwhelming. Many individuals face uncertainty about where to begin. They might struggle with managing debt or saving for significant life events. This guide aims to demystify personal finance. It […]

Understanding Required Minimum Distributions (RMDs): A Guide to Your Retirement Withdrawals

Introduction For decades, you focused on building your retirement savings. You made consistent contributions to your 401(k) and IRA, watched your money grow, and carefully planned for your golden years. Now, a new phase of retirement planning begins: withdrawing that money. The IRS has a specific set of rules that govern how and when you […]

Navigating Your Retirement: A Guide to Creating a Retirement Budget

Introduction For many, the idea of retirement is about freedom—the freedom to travel, to pursue hobbies, and to spend more time with family. However, this freedom comes with a significant financial responsibility. You will no longer have a regular paycheck, so your retirement savings must support your lifestyle for decades. The key to a secure […]

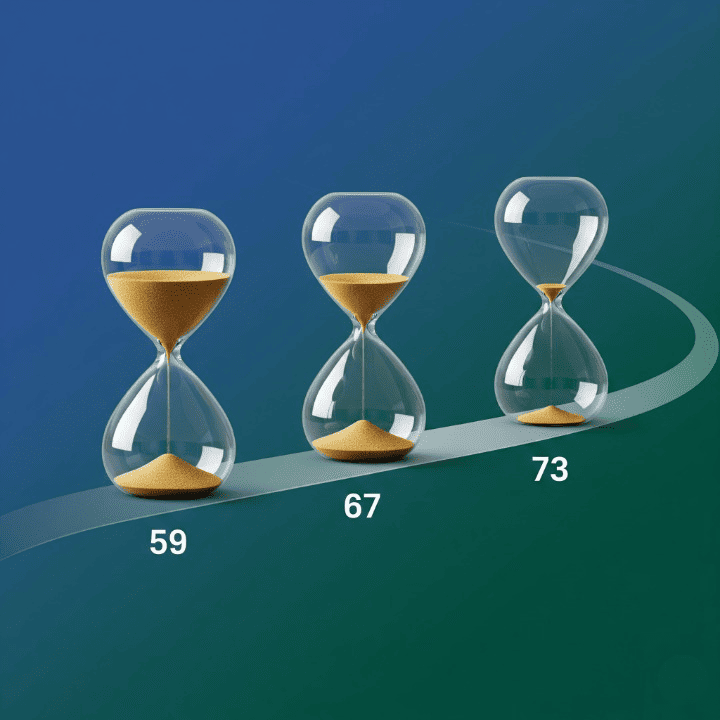

Understanding the Different Retirement Ages: A Guide to Financial Freedom

Introduction The term “retirement age” is a concept most people are familiar with. It often conjures a single number—like 65 or 67—that marks the end of our working lives. However, in reality, there’s no one-size-fits-all retirement age. Instead, there are several key ages that have a significant impact on your retirement planning and financial future. […]

Understanding Pensions: A Guide to Defined Benefit Plans in Retirement

Introduction For decades, the pension was a cornerstone of retirement security. It promised a guaranteed income for life after a career with a single company, providing a clear path to a comfortable and worry-free retirement. While modern retirement plans like 401(k)s and IRAs have largely replaced traditional pensions, these defined benefit plans still exist, particularly […]

The Longevity Economy: Financial Planning for a Longer Life

Introduction The prospect of living a longer life is one of modern society’s greatest achievements. People are now living well into their 80s, 90s, and even beyond. While this offers incredible opportunities for extended time with family and personal pursuits, it also presents a significant challenge for retirement planning. A longer lifespan means a longer […]

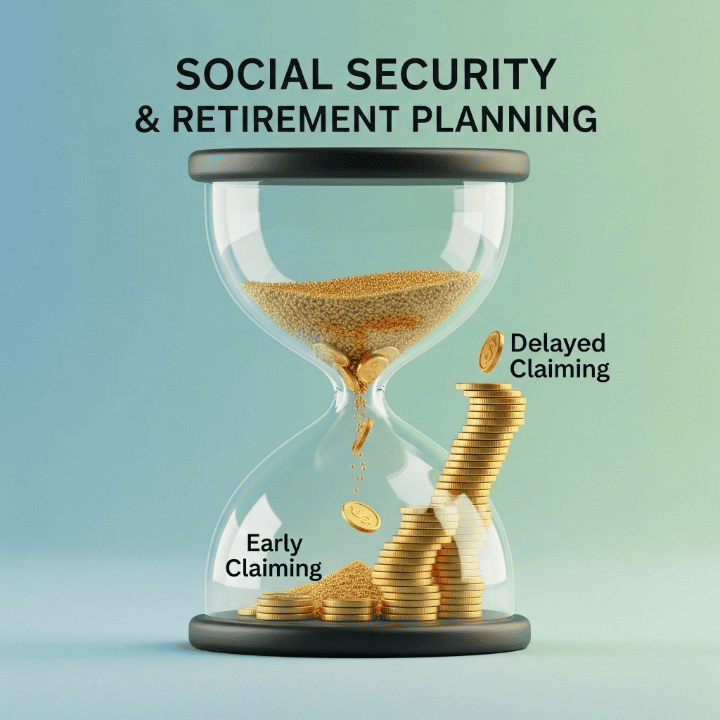

Planning for Retirement: The Power of Social Security and Your Financial Future

Introduction For many people, the idea of retirement feels like a distant dream. It’s easy to get caught up in the day-to-day of work and bills, pushing long-term planning to the back burner. Yet, for most Americans, Social Security will be a foundational part of their retirement income. Understanding how it works, when to claim […]

Retirement Planning 101: Understanding 401(k) vs. Roth IRA

Introduction Planning for retirement can feel like a daunting task. Many people know they need to save, but they get stuck trying to figure out which accounts to use. The choice between a 401(k) and a Roth IRA is one of the most common and important decisions you will face on your journey to financial […]