Introduction

When you start investing, you’ll often hear about the magic of compounding. While the term might sound complex, the concept is incredibly simple and is arguably the most powerful force for building wealth over time. In a nutshell, compounding is the process of earning returns on your initial investment and then earning returns on those returns. This simple idea, when given enough time, can transform even small, consistent savings into a massive nest egg. Understanding how compounding works is not just an academic exercise; it’s a foundational principle of sound financial planning that can change your life. This comprehensive guide will demystify the power of compounding, show you how it works in real-world scenarios, and provide actionable steps to help you harness this force to achieve your long-term financial goals.

What Exactly is Compound Interest?

Compound interest is interest calculated on the initial principal and also on all the accumulated interest of previous periods. Think of it this way: if you invest $100 and it earns 10% in one year, you will have $110. In the second year, if you keep the money invested, you will earn 10% not on the original $100, but on the new total of $110. That means you’ll earn $11 in interest, bringing your total to $121. The small extra dollar you earned is the magic of compounding at work.

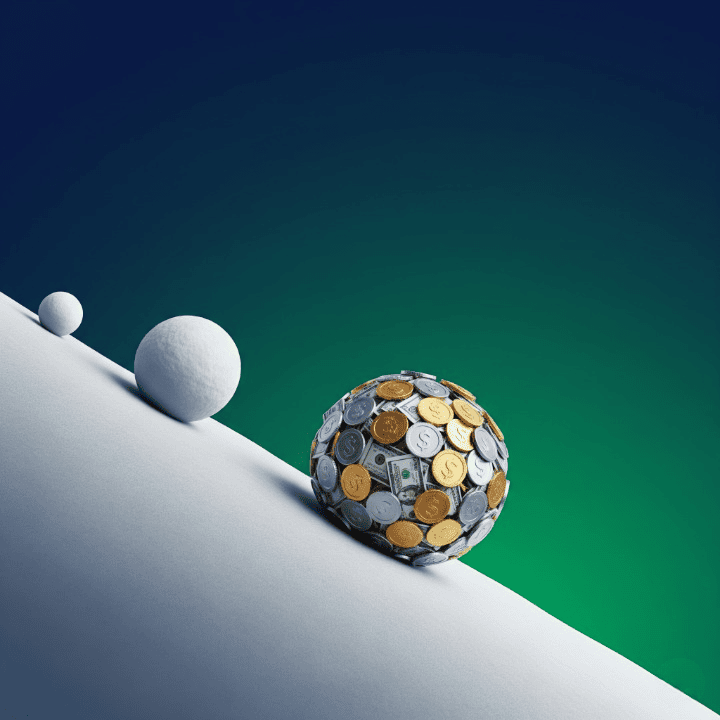

This effect might seem small at first, but over a long period, it creates an exponential growth curve. The longer your money is invested, the more powerful compounding becomes. It’s a snowball effect that starts slowly but builds momentum over time, growing faster and faster as it rolls down the hill. This is why time is the single most valuable asset for an investor.

Simple vs. Compound Interest: A Visual Example

To truly appreciate the power of compounding, let’s look at a simple example. Imagine you have two friends, Alex and Ben, both with $10,000 to invest at an annual return of 10%.

- Alex’s Simple Interest: Alex decides to take out his interest earnings each year. He will earn $1,000 per year. After 30 years, he will have his initial $10,000 plus $30,000 in interest for a total of $40,000.

- Ben’s Compound Interest: Ben decides to reinvest all his interest earnings. He doesn’t touch the money. After 30 years, his initial $10,000 will have grown to more than $174,000.

Ben’s money grew over four times more than Alex’s, even though they started with the same amount and earned the same annual return. The only difference was that Ben let his money compound.

The Most Important Factor: Time

While your rate of return matters, time is the most critical element in compounding. The earlier you start investing, the more time you give your money to grow exponentially. Consider two investors, Sarah and Mike, both aiming to retire at age 65.

- Sarah: She starts investing $3,000 a year at age 25 and stops at age 35. She only invests for 10 years, putting in a total of $30,000.

- Mike: He waits until age 35 to start. He invests $3,000 a year every year until he retires at 65. He invests for 30 years, putting in a total of $90,000.

Assuming an average annual return of 8%, Sarah’s money will have grown to over $400,000 by the time she retires. Mike, despite investing three times as much money, will have less than $370,000. Sarah’s earlier start gave her money an extra decade to compound, and that head start made all the difference. This illustrates why even small, consistent investments at a young age can be far more powerful than larger investments later in life.

How to Harness the Power of Compounding

Putting the theory of compounding into practice is the most important step. Here are some actionable strategies to help you get started.

1. Start Now

This is the single most important piece of advice. Don’t wait until you have a large amount of money. Start with what you can, even if it’s just $50 a month. The earlier you begin, the more time your money has to grow.

2. Make Consistent Contributions

The steady, regular investment of money is a core part of effective financial planning. This strategy, known as dollar-cost averaging, helps you build wealth over time and smooths out the effects of market volatility. By investing a fixed amount regularly, you buy more shares when prices are low and fewer when prices are high.

3. Reinvest Your Returns

Many investors choose to automatically reinvest their dividends and capital gains to buy more shares of the same stock or fund. This process is the simplest way to ensure your money is continuously compounding without any effort on your part. Most brokerage firms offer this feature for free.

4. Choose a Tax-Advantaged Account

Compounding is most effective when your money is not being taxed along the way. Use retirement accounts like a 401(k) or IRA, where your money grows tax-deferred or tax-free. This allows you to keep more of your returns and let them compound over time.

5. Be Patient and Disciplined

The market will have ups and downs. It can be tempting to panic and pull your money out during a downturn. However, for compounding to work, you must stay the course. The most successful investors are those who can resist the urge to make emotional decisions and remain invested for the long term.

The Role of Compound Interest in Your Financial Goals

The power of compounding isn’t limited to retirement. You can apply this principle to any long-term savings goal.

- Saving for a Down Payment: By consistently saving and investing your money in a diversified portfolio, you can reach your goal much faster.

- Building an Emergency Fund: While your emergency fund should be in a safe, liquid account, you can still put it in a high-yield savings account to earn a small amount of interest that compounds.

- College Savings: For a child’s education, starting early and consistently contributing to a tax-advantaged account like a 529 plan can make a massive difference in the final amount you have.

Conclusion

The power of compounding is a fundamental principle that underpins all successful long-term investing. It is the process where your returns earn returns, and it can turn even modest savings into a substantial fortune. The key to harnessing this power is simple: start early, be consistent, and stay invested for the long term. By taking these steps and making a commitment to your financial planning, you are not just saving money; you are building a powerful wealth-creation engine that will work for you 24/7. It’s a testament to the idea that small, disciplined actions today can lead to life-changing results tomorrow.