Introduction

The term “retirement age” is a concept most people are familiar with. It often conjures a single number—like 65 or 67—that marks the end of our working lives. However, in reality, there’s no one-size-fits-all retirement age. Instead, there are several key ages that have a significant impact on your retirement planning and financial future. Understanding the difference between these ages is crucial for making informed decisions about your savings, Social Security benefits, and healthcare. Failing to understand these distinctions can cost you thousands of dollars and may even force you to work longer than you’d like. This comprehensive guide will demystify the different retirement ages, explain their importance, and provide you with a clear roadmap to help you choose the best time to retire for you.

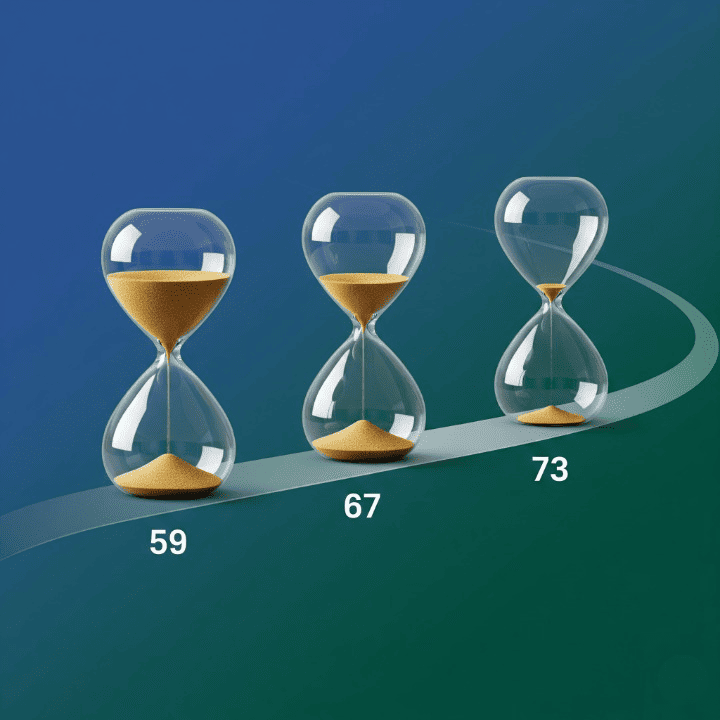

The Three Key Retirement Ages You Need to Know

1. Early Retirement Age

This is the age at which you can first start taking distributions from your retirement accounts without incurring a tax penalty. For most people, this is age 59½.

- Why it matters: Accessing your retirement savings before this age (with a few exceptions) can result in a 10% penalty on your withdrawal, on top of any income taxes you may owe. This penalty is a powerful deterrent designed to encourage you to keep your money invested for the long term.

- Flexibility: For many, the ability to retire early is a major goal. Achieving this requires a solid financial planning strategy that includes significant savings in a taxable brokerage account or in a Roth IRA (where you can withdraw your contributions penalty-free at any time).

2. Full Retirement Age (FRA)

This is the age at which you can claim 100% of the Social Security benefits you have earned. It is determined by your birth year. For those born in 1960 or later, the FRA is 67.

- Why it matters: Claiming Social Security before your FRA will result in a permanent reduction in your monthly benefit, which can be as much as 30% if you claim at age 62. On the other hand, delaying your benefits past your FRA can result in an even higher monthly payment.

- Strategy: Deciding when to claim Social Security is a complex but crucial choice. Claiming early provides a cash flow, which can be helpful if you need to retire early due to health or a job loss. However, delaying your benefits, if you can afford to, can provide a significant, inflation-adjusted income stream for the rest of your life. For many, delaying to age 70 is the most powerful strategy.

3. Required Minimum Distribution (RMD) Age

The RMD age is when the IRS requires you to start taking distributions from your Traditional retirement accounts (like a 401(k) and Traditional IRA). This is to ensure you eventually pay taxes on the money that has been growing tax-deferred for years.

- Why it matters: For many people, the RMD age is now 73 (for those who turn 72 after December 31, 2022). Failing to take your RMD can result in a significant tax penalty.

- Strategy: A smart investing strategy factors in your RMDs. If you have a large amount of money in a Traditional IRA, your RMDs could push you into a higher tax bracket in retirement. This is a key reason why many financial planners recommend diversifying your savings between Traditional and Roth accounts, as Roth accounts are not subject to RMDs.

How the Different Ages Affect Your Financial Strategy

Understanding these ages allows you to build a more strategic and flexible retirement plan.

In Your 20s and 30s

Focus on saving and investing. Your primary goal should be to contribute to your 401(k) to get the employer match, and then to a Roth IRA. These ages are about building a solid foundation and letting compound interest work its magic. The early retirement age and RMDs are too far away to have a major impact on your strategy, but it’s still wise to save with a long-term perspective.

In Your 40s and 50s

This is a critical period for assessing your progress and making adjustments. You should be maxing out your retirement contributions if you can. You should also be thinking about your retirement goals and what your spending might look like in retirement. This is the time to start analyzing different scenarios for when to claim your Social Security benefits, as the decision will have a major impact on your income.

In Your 60s and Beyond

This is when the different ages become very real.

- Age 62: You can start your Social Security benefits, but you will receive a permanently reduced amount.

- Age 65: This is the age of Medicare eligibility. You can apply for Medicare to cover your healthcare costs, which is a major expense for most retirees.

- Full Retirement Age: You can now claim 100% of your Social Security benefits.

- Age 70: This is the age when your Social Security benefits reach their maximum value.

- Age 73: Your RMDs begin.

Conclusion

Retirement isn’t a single event marked by a single age. It is a long journey with several key milestones that can significantly impact your financial well-being. By understanding the difference between your early retirement age, your full retirement age, and your RMD age, you can make smarter decisions about your savings, investing, and Social Security. The choices you make today will determine the financial security and freedom you have in your later years. Don’t let these important ages be a mystery. Take the time to understand them and build a thoughtful retirement planning strategy that works for you.