Introduction

In a world dominated by traditional financial institutions, a revolutionary movement is reshaping how we think about money. Many people find the current financial system opaque, restrictive, and full of intermediaries. These middlemen often add costs and complexity. Simple actions like sending money abroad or securing a loan involve a web of banks and brokers. What if a more direct, transparent, and accessible alternative existed? Decentralized Finance, or DeFi, aims to be that alternative. It is an emerging ecosystem of financial applications built upon innovative blockchain technology. These applications operate without any central authority.

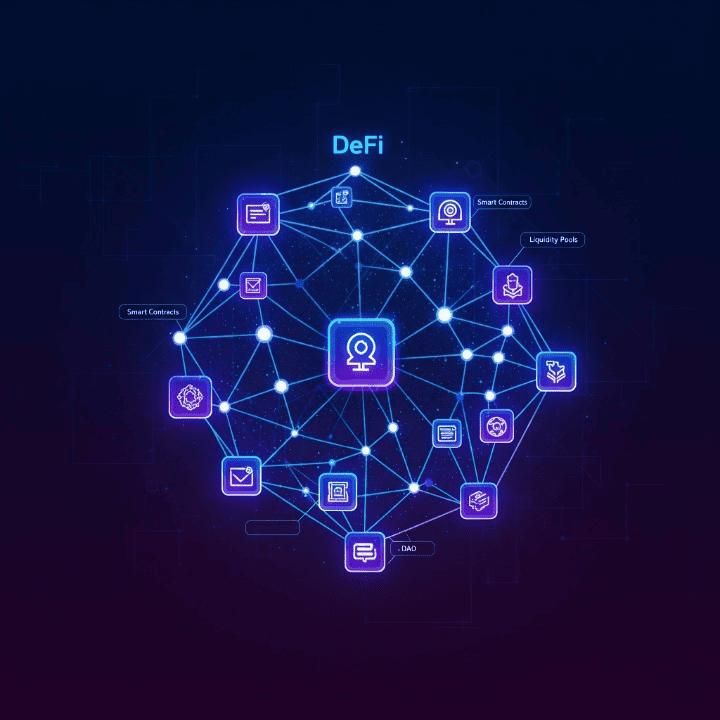

DeFi offers a parallel financial system where users can interact directly with each other. They use smart contracts to lend, borrow, trade, and earn interest. Understanding what decentralized finance is and how it functions is the first step toward appreciating its power. It has the potential to democratize access to financial services and create a more inclusive global economy. This guide will demystify its core concepts, explore its key applications, and outline the opportunities and risks involved.

The Core Pillars of DeFi: Smart Contracts and Blockchain

To truly grasp DeFi, you must first understand its two foundational pillars: blockchain technology and smart contracts. Blockchain is the distributed, immutable digital ledger that powers cryptocurrencies like Bitcoin and Ethereum. Think of it as a shared record book. This book is duplicated and spread across a vast network of computers. Its decentralized nature makes it incredibly secure and transparent. No single entity can alter the records without the network’s consensus. Every transaction is recorded in a “block” and added to a “chain,” creating a permanent and verifiable history for all to see.

Smart contracts build on this secure foundation. They are not contracts in the traditional legal sense. Instead, they are self-executing programs with an agreement’s terms written directly into code. They run on a blockchain, most commonly Ethereum, and automatically perform their functions when certain conditions are met. For example, a smart contract could release funds to a user after they deposit a specific amount of collateral. Because they operate on the blockchain, their execution is guaranteed and tamper-proof. This process eliminates the need for intermediaries like banks or lawyers to enforce the agreement. This automation and trustlessness make the entire DeFi ecosystem possible. Together, blockchain provides the secure environment, while smart contracts provide the logic to build sophisticated financial tools.

Exploring Key DeFi Protocols and Applications

The DeFi ecosystem is a vibrant landscape of decentralized applications, or “dApps.” These protocols aim to replicate and improve upon traditional financial services. Understanding these key areas helps clarify the practical utility of decentralized finance. We can break down the most popular applications into a few main categories.

Decentralized Exchanges (DEXs)

One of the most popular applications is the Decentralized Exchange (DEX). Centralized exchanges hold your funds and facilitate trades. In contrast, DEXs allow users to trade digital assets directly from their own wallets. Smart contracts and “liquidity pools” make this possible. In these pools, users lock up pairs of assets to provide trading liquidity for others. These liquidity providers earn a share of the transaction fees in return for their service.

Lending and Borrowing Platforms

Lending and borrowing are also major components of DeFi. DeFi lending platforms enable users to lend their crypto assets and earn interest. They can also borrow assets by providing other cryptocurrencies as collateral. Smart contracts manage the entire process. They set interest rates algorithmically based on supply and demand. This creates a more open and accessible market for credit. Anyone can become a lender or a borrower without needing approval from a bank.

Yield Farming and Staking

Finally, yield farming and staking represent more advanced strategies to generate returns. Staking involves locking up a specific cryptocurrency to help secure its network. In exchange for their contribution, stakers receive rewards, similar to earning interest. Yield farming, also known as liquidity mining, is a more complex practice. It involves strategically moving crypto assets between different DeFi protocols to maximize earnings. This could involve lending on one platform and providing liquidity on another. These strategies are more intricate but highlight the composable nature of DeFi, where applications work together like financial building blocks.

How to Participate in DeFi: A Step-by-Step Overview

Engaging with decentralized finance for the first time can seem daunting. However, the process can be broken down into a few logical steps. Please note this overview is for educational purposes only and is not a recommendation of any specific action. The first requirement is a self-custody digital wallet. This software allows you to store and manage your digital assets securely. Unlike a traditional bank account, you have complete control over your funds. This means you are responsible for safeguarding your private keys or seed phrase.

Once your wallet is set up, you need to acquire the necessary cryptocurrencies. Most DeFi applications run on the Ethereum blockchain. Therefore, having Ether (ETH) is often essential for transactions and to pay for “gas” fees. You can acquire crypto from a centralized exchange and then transfer it to your self-custody wallet. It is crucial to be extremely careful during this process. Always double-check wallet addresses to ensure funds are sent to the correct destination.

With a funded wallet, you can begin to interact with DeFi protocols. This involves connecting your wallet to a dApp’s web interface. When you connect, the dApp can view your public wallet address and assets. It cannot access your funds without your explicit permission. Every interaction that involves moving funds requires you to sign and approve the transaction in your wallet. Each transaction also incurs a gas fee, which can fluctuate based on network congestion. Starting with small, experimental amounts is a prudent way to familiarize yourself with the mechanics.

Understanding the Risks and Rewards of DeFi

While DeFi offers compelling rewards, you must approach the space with a clear understanding of its risks. The potential for high returns is a significant draw for many, especially through strategies like yield farming. The ability to earn passive income on digital assets often far exceeds what traditional savings accounts offer. Furthermore, DeFi’s accessibility and transparency provide a level of user control not available in the legacy system. Anyone with an internet connection can access these global financial markets.

However, these rewards come with substantial risks. Smart contract risk is a primary concern. Since humans write the code, these protocols can contain bugs or vulnerabilities. Malicious actors can exploit these flaws, potentially leading to a complete loss of funds. Impermanent loss is another critical concept for anyone providing liquidity to DEXs. This is a potential loss in value that occurs when the price ratio of two assets in a pool changes significantly. Additionally, the space is still maturing, and regulatory uncertainty looms large. Governments are still deciding how to approach DeFi, and future rules could impact the ecosystem. The high volatility of crypto assets also means your investments can fluctuate dramatically. A full understanding of these risks is essential for navigating DeFi responsibly.

The Future of Finance: DeFi’s Potential to Reshape Industries

The long-term vision for decentralized finance extends beyond simply copying existing financial products. Its core principles of transparency, decentralization, and user sovereignty can reshape many industries. The concept of “composability” allows for an incredible rate of innovation. Different DeFi protocols can seamlessly interact, like Lego bricks. Developers can build new, complex financial products by combining existing ones. This creates a system that is constantly evolving.

Looking ahead, DeFi could revolutionize areas like insurance. Smart contracts could manage parametric insurance products, automating payouts instantly after a verifiable event like a flight cancellation. In real estate, tokenizing property could create more liquid markets and enable fractional ownership. This would lower the barrier to entry for property investment. Global trade finance could also be streamlined. Transparent, self-executing smart contracts could release payments as goods move through the supply chain, reducing paperwork and delays. While the technology is still early and faces hurdles in scalability and user experience, its potential is undeniable. It represents a paradigm shift from a closed, institution-centric model to an open, user-centric one.

Conclusion

Decentralized Finance represents a profound shift in the financial landscape. It is moving us away from closed, centralized systems toward an open and transparent ecosystem. DeFi leverages blockchain and smart contracts to provide a compelling alternative for lending, borrowing, and trading. It puts users in direct control of their funds, fostering a level of financial sovereignty that was previously unimaginable. We have explored its core components, from the security of blockchain to the logic of smart contracts. We also delved into its primary applications, including DEXs and lending protocols.

However, this innovative frontier is not without its perils. The significant risks demand caution, diligence, and a commitment to continuous learning. These risks include smart contract vulnerabilities, impermanent loss, and the volatile nature of the assets themselves. As the technology matures and overcomes its current challenges, its potential to democratize finance remains immense. For anyone seeking to understand the future of finance, a deep dive into the world of DeFi is no longer optional; it has become essential.